What Happens When You Work While Receiving Social Security?

Whether out of choice or necessity, it is becoming increasingly common for individuals to work past their full retirement age. Electing to receive Social Security payments while working can reduce the benefits you receive. To what degree depends on your age and level of earned income.

There is no reduction to your Social Security benefit for any earned income if you work to or past your full retirement age. If you were to elect to receive benefits prior to your full retirement age, benefits are reduced if your earned income exceeds certain thresholds. These thresholds are adjusted annually.

If an individual elects to receive Social Security benefits and is younger than their full retirement age for all of 2019, benefits are reduced by $1 for every $2 earned over $17,640. This earnings threshold is increased in the year an individual attains full retirement age. Benefits would be reduced by $1 for every $3 earned over $46,920. It’s important to note that “earned income” represents total gross wages. Pre-tax deductions to retirement plans do not reduce the extent of the benefit reduction imposed by Social Security.

Any benefits reduced by Social Security are not lost. Benefits received past full retirement age will be adjusted to account for reductions in earlier years. It’s also possible to increase benefits as you continue to work. Should those earnings represent some of your highest-earning years, benefits will be recalculated.

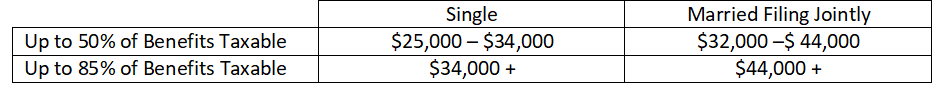

Earned income can also increase the taxability of your Social Security payments. Social Security considers your “combined income” (1/2 of your Social Security + other income) when determining how much of your benefits are taxable:

More information can be found on www.SSA.gov. Contact our office with questions.